Fiserv Bank Account Updates

Bank Account updates for Boarded and Live North merchant accounts can now be made on CoPilot without needing to submit a Bank Account Change or Funding/Billing Frequency Changes tickets.

Note: Self-service updates submitted for the linked North account will not result in Bank Account information being updated for the BlueChex or ProfitStars accounts. ACH merchant accounts will require manual tickets (instructions listed in the KB).

Log in to Copilot and enter the MID or the client's name in the search bar under the Customer Menu.

Click the correct account and click on the Account Detail menu on the left side. Click Account Details in the middle menu.

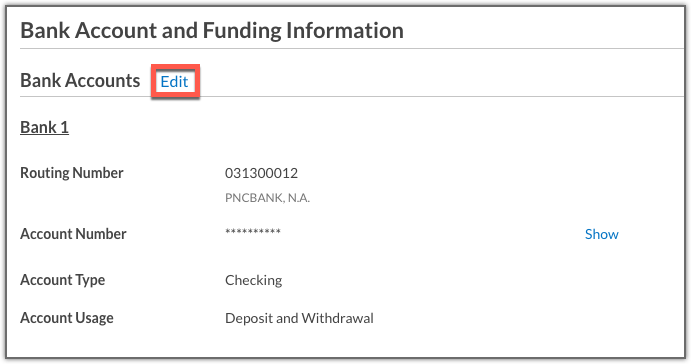

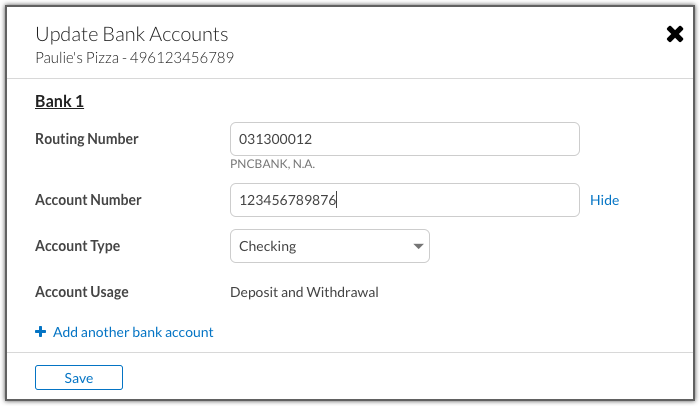

Scroll down and click the Edit text located to the right of the Bank Accounts header to open the Update Bank Accounts modal to update this information.

You cannot edit Bank Account information if there is an existing Bank Information Update that is Pending Review, Awaiting Information, or In Progress.

If there is a Legal Information update that is Pending Review, Awaiting Information, or In Progress for the account and/or a Funding Hold on the account, the Update Bank Accounts modal will detail this information.

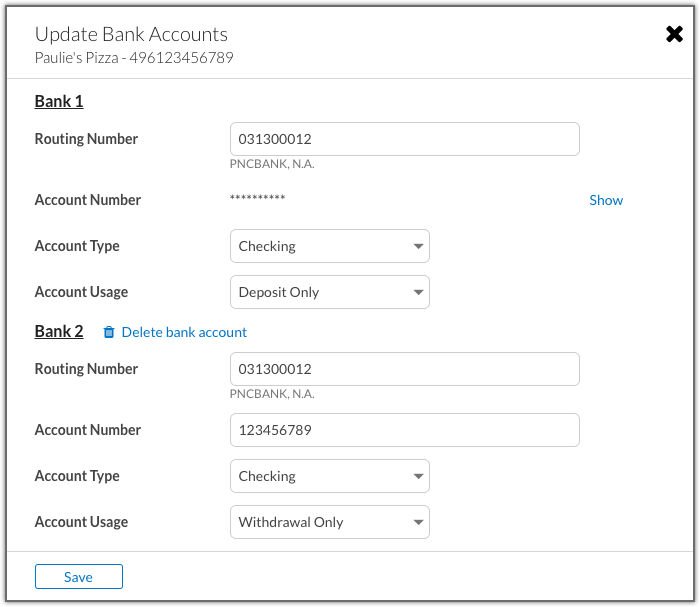

Adding another bank account will set Bank 1 to Deposit Only , and Bank 2 will be set to Withdrawal Only. This can be changed by editing the Account Usage field.

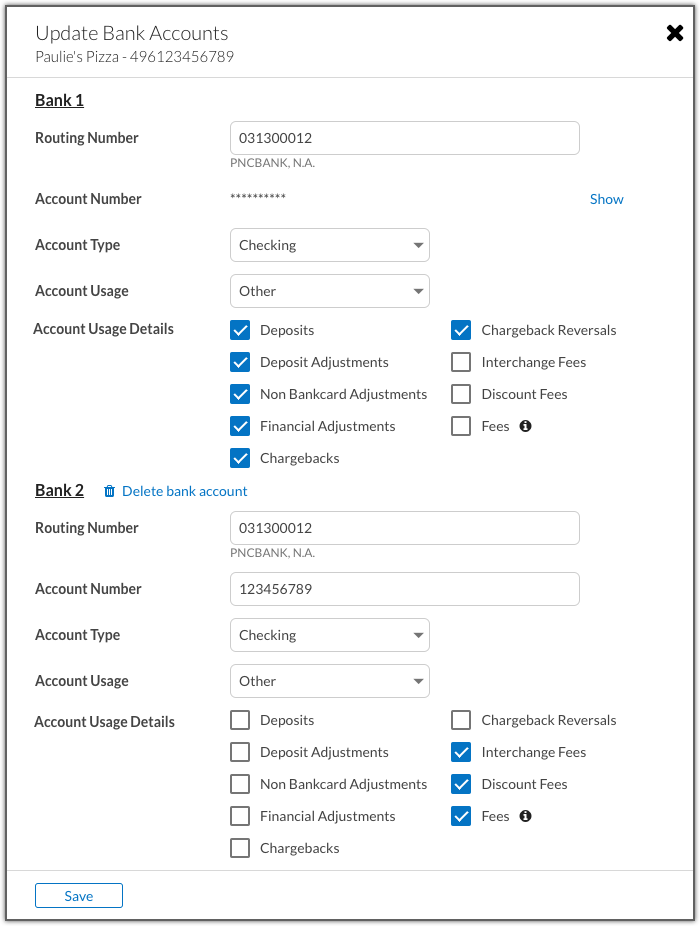

If Other is selected, several checkbox options will display that can be selected to describe the business function of the account.

The following options are available:

- Deposits: Deposit batches

- Deposit Adjustments: Adjustments for deposit activity, such as corrections or rejected transactions

- Non-Bankcard Adjustments: Adjustments for non-bankcard (Discover, American Express, etc.) activity

- Financial Adjustments: Adjustments for resolving processing and billing discrepancies

- Chargebacks: Funds debited from the bank account for chargebacks

- Chargeback Reversals: Funds credited to the bank account for chargeback reversals

- Interchange Fees: Interchange and assessment fees

- Discount Fees: Discount and service fees

- Fees: Fees for authorizing, processing, and settling card transactions. Also includes fees assessed per transaction and fixed fees for account services

The following requirements must be met when selecting Other for the Account Usage field:

- Deposits and Fees cannot be applied to the same bank account.

- The Deposits, Deposit Adjustments, and Non-Bankcard Adjustments options must all be applied to the same account.

- All fee options must be applied to the same bank account.

Click the Delete bank account text to the right of the desired bank account to delete it.

If two bank accounts were previously available and one was deleted, click the Undo delete text to reverse the deletion.

Click Save to save any changes made. An error message will display when saving if the information is not valid. Once an update is submitted, the information will be verified.

Causes for Manual Review

In the following cases, a Bank Account update as described above will not take immediate effect.

- If there is a Legal Information update that is Pending Review, Awaiting Information, or In Progress for the account and/or a Funding Hold on the account, the Update Bank Accounts modal will detail this information.

- If the bank account or owner/business information could not be verified, the update will require documentation and approval before the requested changes can take effect. Required documentation includes:

- Bank Account Change Request Form

- A copy of a non-expired government-issued ID containing a photograph of the application signer

- An official bank letter or voided check that includes the routing and account numbers for the bank accounts that were updated or added

If an update's status is Pending Review or Awaiting Information, the submitter can cancel the update on the Update Details page.

Viewing Account Usage Details

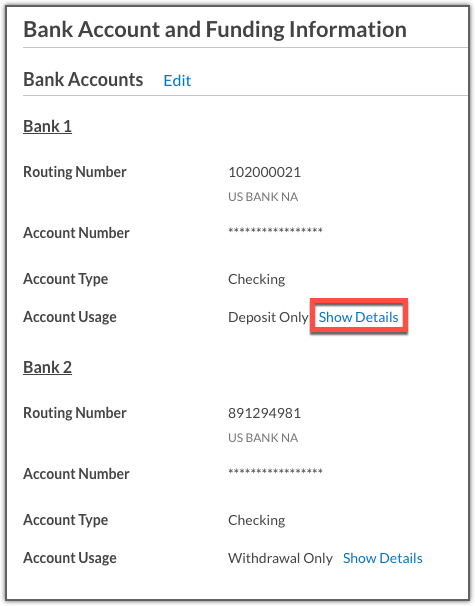

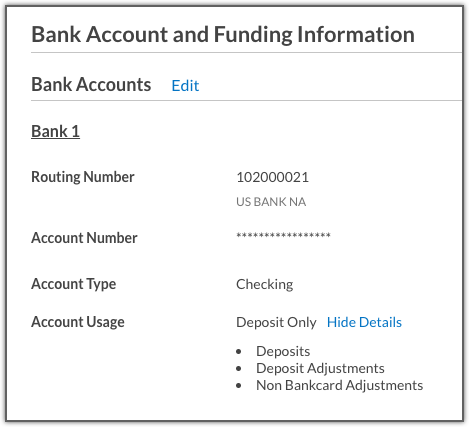

The Account Usage field describes the function of the account as being either Deposit Only, Deposit and Withdrawal, Withdrawal Only, or Other.

If the Account Usage field is not Deposit and Withdrawal, the Account Usage details for each bank account can be viewed by selecting the Show Details option on the Account Details page. This feature is only available for North merchants.

This will display all selected Account Usage categories associated with the bank account.

This field can be viewed on the Account Details page.

The Bank Account update is typically completed within three to five days if no manual review is required. To verify, access the account again in Copilot and go to Account Updates under the Customer Service menu.