PCI Compliance for Nonprofits

A note regarding recent updates to PCI Compliance Standards: As of April 1st, 2024, a new version of PCI Compliance standards, dubbed PCI DSS 4.0,...

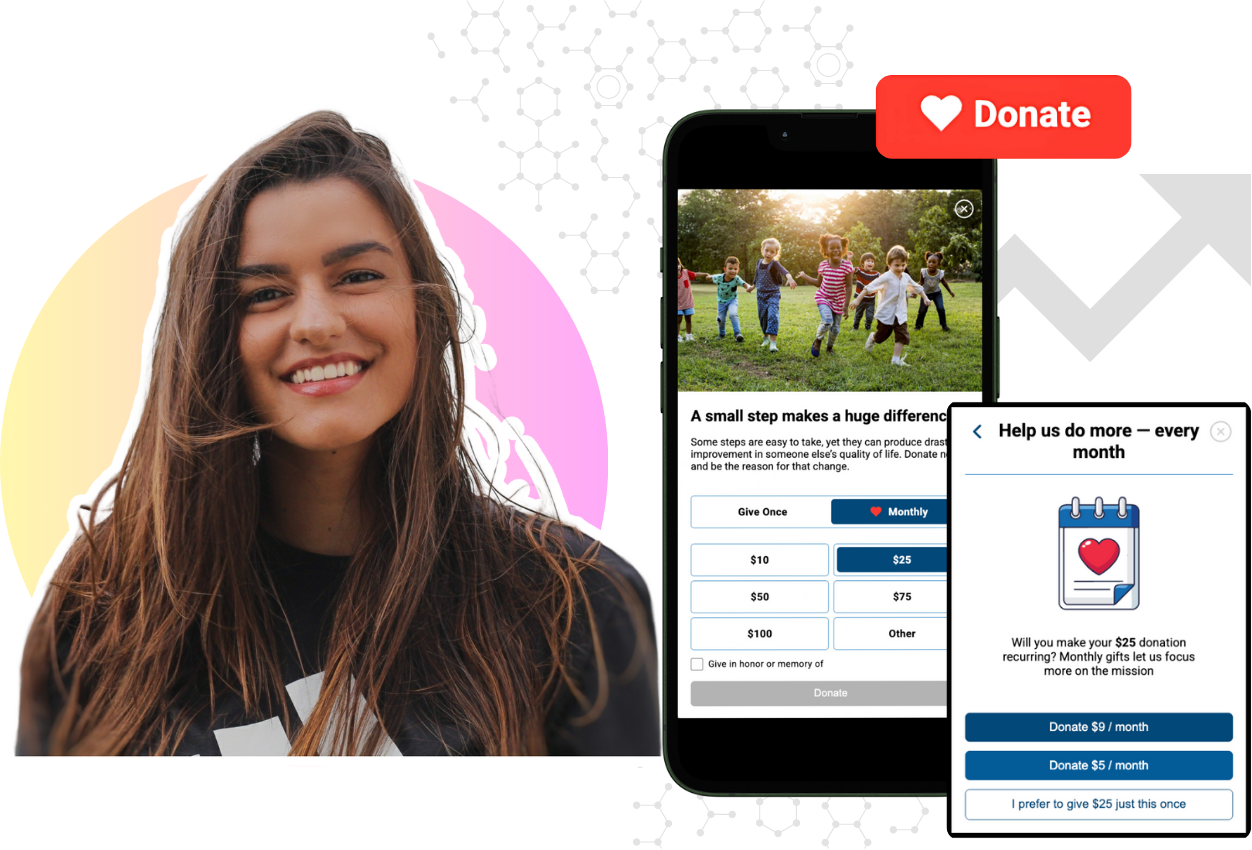

Mobile-First Pop-Up Donation Form

Launch mobile-first pop-up forms in minutes, use built-in tools to capture more donations, and optimize the giving experience—no dev team required.

New to online donation pages for your nonprofit? Start here.

Donation page A/B testing - no science degree needed.

Keep your donation page loading fast - and drive higher conversions.

The 4 Types of Online Donation Experiences

89% of donors leave without giving. Learn how to use the right donation form to close the gap and boost conversions.

3 min read

Kristi Collins

:

June 5

Kristi Collins

:

June 5

Even in today’s age of advanced technology and security, credit card fraud continues to be a widespread issue – and one of the most prevalent methods of fraud overall.

The FTC reported that consumers lost more than $10 billion to fraud in 2023, a 14% increase over 2022.

With over 425,000 reported cases of credit card fraud in 2023 (a 5% increase year over year), it’s becoming more apparent that this issue, despite advancing security, is still a rampant issue.

Unfortunately, nonprofits are not immune to credit card fraud.

Donation pages are often easy targets for credit card testing fraud due to unsecured forms. As long as these pages aren’t updated to meet current security standards, nonprofits remain vulnerable.

While updating security measures won't eliminate fraud entirely, it significantly enhances donor information protection, which is a crucial step forward.

In this blog, we'll cover an overview of credit card testing fraud, how to identify it, its impact on your nonprofit, and how to ensure your donation pages and forms maintain proper transaction security.

Credit card testing fraud occurs when stolen card information is used to make small transactions online, often as donations on nonprofit websites, to see if the card information is active for additional usage.

Successful small transactions typically mean the card information is valid for additional usage.

Nonprofits are common targets for this type of fraud due to their accessible online donation pages and often less sophisticated security measures, opening the door for testing of solen card information quickly and discreetly.

Spotting credit card testing patterns can be challenging, especially if you don't regularly monitor your donation transactions.

Here are key indicators to watch for when assessing potential credit card testing fraud:

From reduced trust to negative financial impact, credit card testing fraud can impact your nonprofit in numerous ways.

Alan Saway outlined 5 key ways nonprofits are impacted by credit card testing fraud in his article “How Nonprofits Can Protect Themselves from Card-Testing Fraud”, which can be found below:

Your nonprofit may not be able to stop all instances of credit card fraud on your donation pages.

But, by implementing standard security measures, you can significantly reduce the risk of fraud.

Here are a few ways to keep your donation pages and forms secure:

Credit card fraud might not be completely avoidable, but you can lower the risk by making sure your nonprofit’s donation pages and forms are secure.

Learn to spot credit card testing fraud and use secure donation pages to protect your nonprofit.

If you need a safe donation page, iDonate has you covered.

Our platform offers top-notch security and lets you create donation pages that fit your brand.

Need more info? Check out our security overview here.

A note regarding recent updates to PCI Compliance Standards: As of April 1st, 2024, a new version of PCI Compliance standards, dubbed PCI DSS 4.0,...

On a daily basis, we all see how businesses in the for-profit world build relationships with consumers by addressing the interests, lifestyles, and...

I’ve been hearing versions of this quote a lot lately: